Banks… Non-banks… and Private Lending (the World’s second oldest profession)

As finance industry professionals, you probably receive a lot of information about economic indicators, RBA activity, rental and housing markets etc … Maybe you even read some of it!

But what I want to briefly talk about today is very basic – just like private lending itself. In the end, there are only three types of mortgage loans. Bank, non-banks and genuine “home office” private lenders.

However, there is always a combination of compliance, timing and price in context of actual borrower needs and what is really “do-able” in that context, and it is that combination which determines the the logical loan source.

If you have plenty of time (and from what I’m told, I do mean plenty) to set a deal; the application complies in all of the usual servicing and gearing regards, and therefore qualifies for the best price, then there is no doubt – banks are for you.

Increasingly though, that’s not the case.

Non-bank, institutional funding is an option of course. However, from what I understand in talking to finance brokers, there’s not a lot of difference between the compliance and timing requirements of banks and non-bank lenders.

There are many non-bank lenders who claim they are “private” lenders. Most are not.

Private Mortgage Lenders VS Non-bank lenders, which includes

Mortgage Funds/Trusts Mortgage Syndications

Other “Tier 1” and “Tier 2” lenders

Are there any other non-bank lending platforms I have missed? Probably. A rose by any other name …

So, what’s the difference and why does it matter?

Over the past few years particularly, there has been a plethora of funding platforms and mechanisms that have sprung up, purporting to be “private” lenders, when what they generally are is non-bank financial institutions governed by strict, published guidelines, rules and regulations. There may be limited flexibility.

CONFUSED?

It’s simple really.

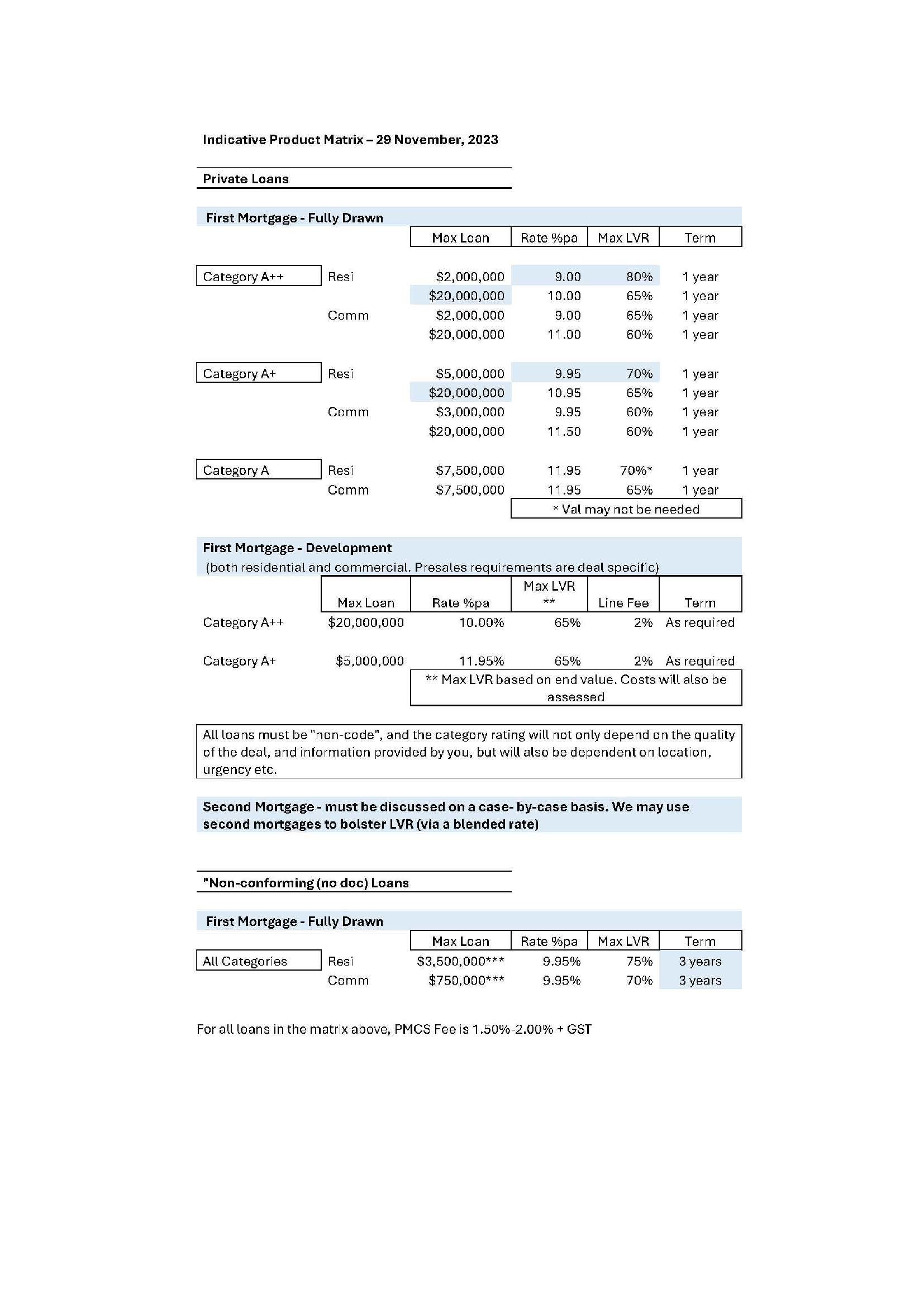

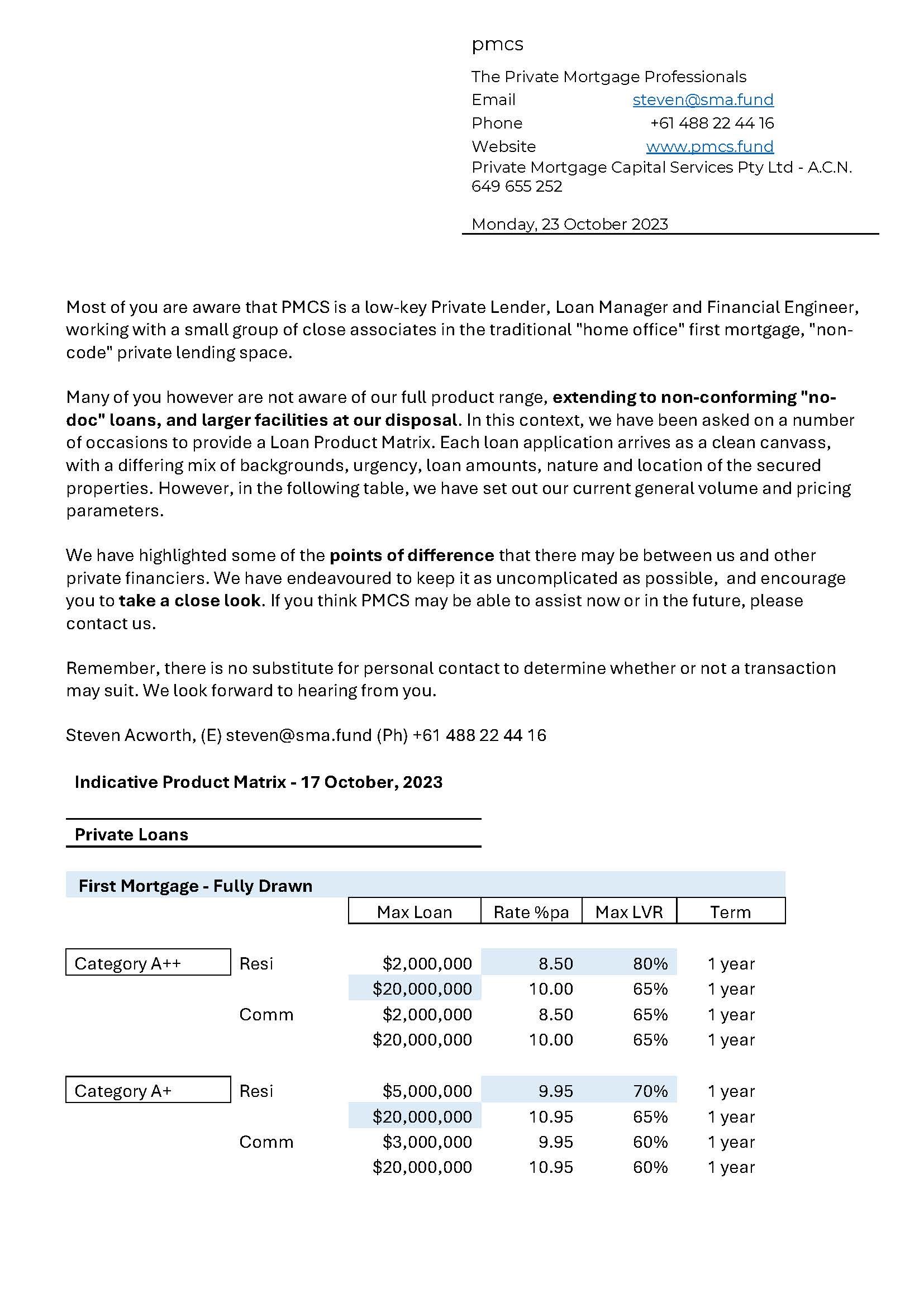

A private mortgage is a financial arrangement between a borrower and a private, individual lender. It is a specialist vocation. We are more difficult to find. Our pricing is on a deal-by-deal basis and takes into account the loan amount, term, LVR, urgency, location, nature of the security property, and many other factors.

Usually, genuine private lender's stay within a loan size range of between $1.00M and $5.00M. Seriously, how many “home office” private investors are there prepared to invest more than $5.00M into individual loans? And does the price reduce according to the loan size? Generally, not. For the same reason. The larger the loan, the more rarified the air.

Loan terms are usually no more than 12 months, and often less.

Why does it matter?

Timing is of the essence.

Yes, private lenders are generally more expensive, but the price is a reflection of risk perception. They make their own decisions. It is usually a one-on-one relationship with the borrower. It is generally focused on the asset itself. There are no hard and fast compliance issues, other than abiding by the responsible lending guidelines governing all lenders. Each deal starts as a blank canvass.

This means applications may be assessed and settled quickly with access to private funds for those in need of an efficient and flexible solution.

It’s horses for courses!

Remember, if you are quoted a loan pricing that is generally below that across the broader private lending market (currently 10-12.50%pa), you are probably dealing with a “non-bank” lender, not a private one, with the potential guidelines and timing restrictions that may entail.

I have over 40 years in the private lending industry. To find out more, please call or email me; let’s make a deal.

Steven Acworth Ph +61 488 22 44 16 Email steven@sma.fund